Mileage Reimbursement 2021 Form – The IRS Mileage Rate 2021 continues to be introduced through the Internal Revenue Service in the last month 2020. This doc provides information on the mileage charges relevant to automobiles which can be employed for enterprise, medical and other functions. This short article will supply helpful perception about Mileage Reimbursement 2021 Form.

What’s the IRS Mileage Rate?

The default per-mile cost set through the Internal Revenue Service (IRS) is named standard mileage rate. It could also be known as mileage for each diem or deductible mileage. It is set up and controlled to ensure that taxpayers can deduct car expenditures for business, health-related, and charitable purposes. The IRS adjusts the rate every year.

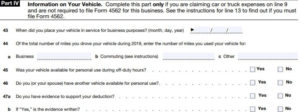

The Mileage Reimbursement 2021 Form could be particularly helpful for self-employed people or small-scale businesses to calculate their automobile expenses and to deduct tax. Employers and business owners who select to use the IRS mile rate can compute their costs in a a lot less complicated way than if they needed to monitor all car expenses (gas, tires, insurance and registration charges).

The standard company mileage rate can only be used for excursions that are linked to work. This tax deduction does not implement to every day commutes in between function and home.

What is the IRS Mileage Rate?

The IRS sets the standard mileage rate based mostly within the examination of auto fees and once-a-year information. This was done by Runzheimer International, a third-party analysis company contracted by government agencies. This business collects and evaluates data from all over the country, including gas rates, insurance premiums and maintenance expenses.

Standard mileage deductions for automobiles employed for business reasons are based on the two fixed and variable running expenses. For automobiles which are employed for charitable or medical reasons, standard mileage will likely be deducted primarily based only within the variable expense of running the automobile.

Bare minimum federal legal guidelines create the minimal tax deduction that can be applied to vehicles utilized for charitable functions. It really is intended to reimburse taxpayers who used their pocket funds for volunteer work.

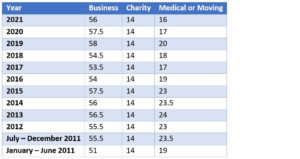

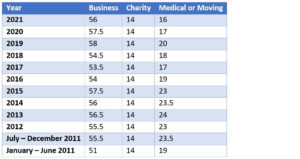

IRS Mileage Rate 2021

The new adjusted Mileage Reimbursement 2021 Form formally applies as of January 1, 2021. It was produced general public in Recognize 2021-02, December 22, 2020. The rates are generally somewhat reduce compared to the 2020 prior year.

They are the main points for Mileage Reimbursement 2021 Form:

- $0.56 per mile for commercial purposes;

- $0.16 per mile if medically necessary;

- $0.14 per mile if used for philanthropic purposes;

- Moving: $0.17 per mile (applied only to active-duty Armed Forces personnel).

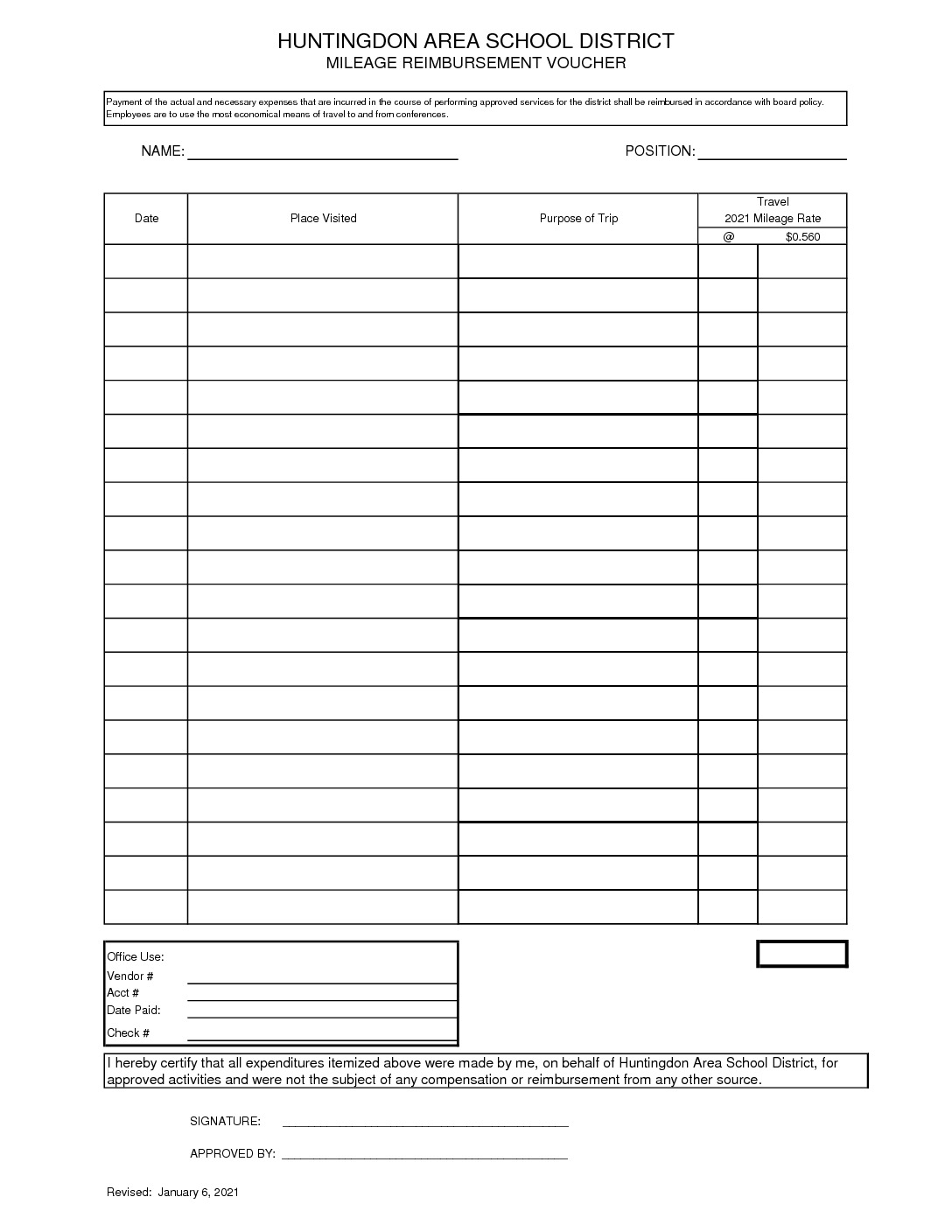

Claim For Reimbursement For Expenditures On Official Business Form

[embeddoc url=”https://irs-mileage-rate.com/wp-content/uploads/2021/08/Claim-For-Reimbursement-For-Expenditures-On-Official-Business.pdf” download=”all” viewer=”browser” text=”Claim For Reimbursement For Expenditures On Official Business Form”][su_button url=”https://irs-mileage-rate.com/wp-content/uploads/2021/08/Claim-For-Reimbursement-For-Expenditures-On-Official-Business.pdf” target=”blank” wide=”yes” center=”yes”]Download Claim For Reimbursement For Expenditures On Official Business (.PDF)[/su_button]

Related For Mileage Reimbursement 2021 Form

[show-list showpost=5 category=”irs-mileage-rate-2021″ sort=sort]