IRS Mileage Reimbursement 2021 Requirements – The IRS Mileage Rate 2021 has been introduced through the Internal Revenue Service within the last month 2020. This doc gives details on the mileage charges relevant to automobiles that are used for company, medical and other functions. This short article will provide useful insight about IRS Mileage Reimbursement 2021 Requirements.

What’s the IRS Mileage Rate?

The default per-mile expense established by the Internal Revenue Service (IRS) is known as standard mileage rate. It may also be called mileage per diem or deductible mileage. It really is established and managed to ensure that taxpayers can deduct car costs for business, medical, and charitable purposes. The IRS adjusts the rate each year.

The IRS Mileage Reimbursement 2021 Requirements may be especially beneficial for self-employed people or small-scale businesses to compute their car expenses and to deduct tax. Employers and business owners who pick to use the IRS mile rate should be able to determine their expenses in a a lot simpler way than when they had to keep an eye on all car expenses (fuel, tires, insurance and registration charges).

The standard business mileage rate can only be utilized for trips which are linked to perform. This tax deduction will not apply to every day commutes between work and residence.

What is the IRS Mileage Rate?

The IRS sets the standard mileage rate based within the analysis of auto fees and yearly information. This was done by Runzheimer International, a third-party research company contracted by government companies. This organization collects and evaluates data from all over the country, which includes gas rates, insurance premiums and maintenance fees.

Standard mileage deductions for vehicles used for enterprise purposes are primarily based on each fixed and variable working fees. For vehicles which are used for medical or charitable functions, standard mileage will probably be deducted primarily based only on the variable expense of running the car.

Bare minimum federal laws create the bare minimum tax deduction which can be applied to autos utilized for charitable functions. It is intended to reimburse taxpayers who used their pocket cash for volunteer perform.

IRS Mileage Rate 2021

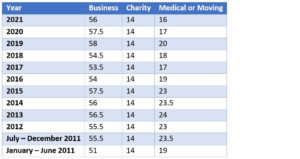

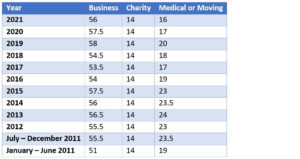

The new adjusted IRS Mileage Reimbursement 2021 Requirements formally applies as of January 1, 2021. It absolutely was created community in Discover 2021-02, December 22, 2020. The rates are typically somewhat reduce compared to the 2020 prior year.

These are the details for IRS Mileage Reimbursement 2021 Requirements:

- $0.56 per mile for commercial purposes;

- $0.16 per mile if medically necessary;

- $0.14 per mile if used for philanthropic purposes;

- Moving: $0.17 per mile (applied only to active-duty Armed Forces personnel).

Claim For Reimbursement For Expenditures On Official Business Form

[embeddoc url=”https://irs-mileage-rate.com/wp-content/uploads/2021/08/Claim-For-Reimbursement-For-Expenditures-On-Official-Business.pdf” download=”all” viewer=”browser” text=”Claim For Reimbursement For Expenditures On Official Business Form”][su_button url=”https://irs-mileage-rate.com/wp-content/uploads/2021/08/Claim-For-Reimbursement-For-Expenditures-On-Official-Business.pdf” target=”blank” wide=”yes” center=”yes”]Download Claim For Reimbursement For Expenditures On Official Business (.PDF)[/su_button]

Related For IRS Mileage Reimbursement 2021 Requirements

[show-list showpost=5 category=”irs-mileage-rate-2021″ sort=sort]